Happy New Year, Chaffey Members!

As we step into 2026, I’m excited to reflect on what we accomplished together in 2025—and share what’s ahead. One year ago in the newsletter, I talked about implementing new technologies here at Chaffey FCU, both that you as members would see and some that you would not see. As I reflect back on 2025, I am so proud of the work that the Chaffey FCU team has put in and all that has been accomplished throughout the year. For those technologies that you can see:

- We updated our website including an upgraded chat feature, allowing easier navigation to find the answers you need

- We set up digital issuance for our debit and credit cards, providing you secure access to your cards in a matter of days instead of waiting for a physical card in the mail

- We rolled out an online portal allowing members to open new accounts, giving you the flexibility to open an account on your time and (in most cases) saving a trip to branch.

Technologies that you as members might not see included improvements in our lending and card servicing departments and upgrading the security systems across our branches. These accomplishments were made possible by the dedicated team at Chaffey FCU, who in the midst of all these updates and changes never took their eyes off our mission of lighting the way for our members to reach their financial goals.

Speaking of goals, have you set goals for yourself for 2026? I will be honest, much like Lucy in the Peanuts® strip below, I do not remember what my personal goals were as we were starting 2025. Writing down your goals—and keeping them somewhere you’ll actually find them—can make a big difference!

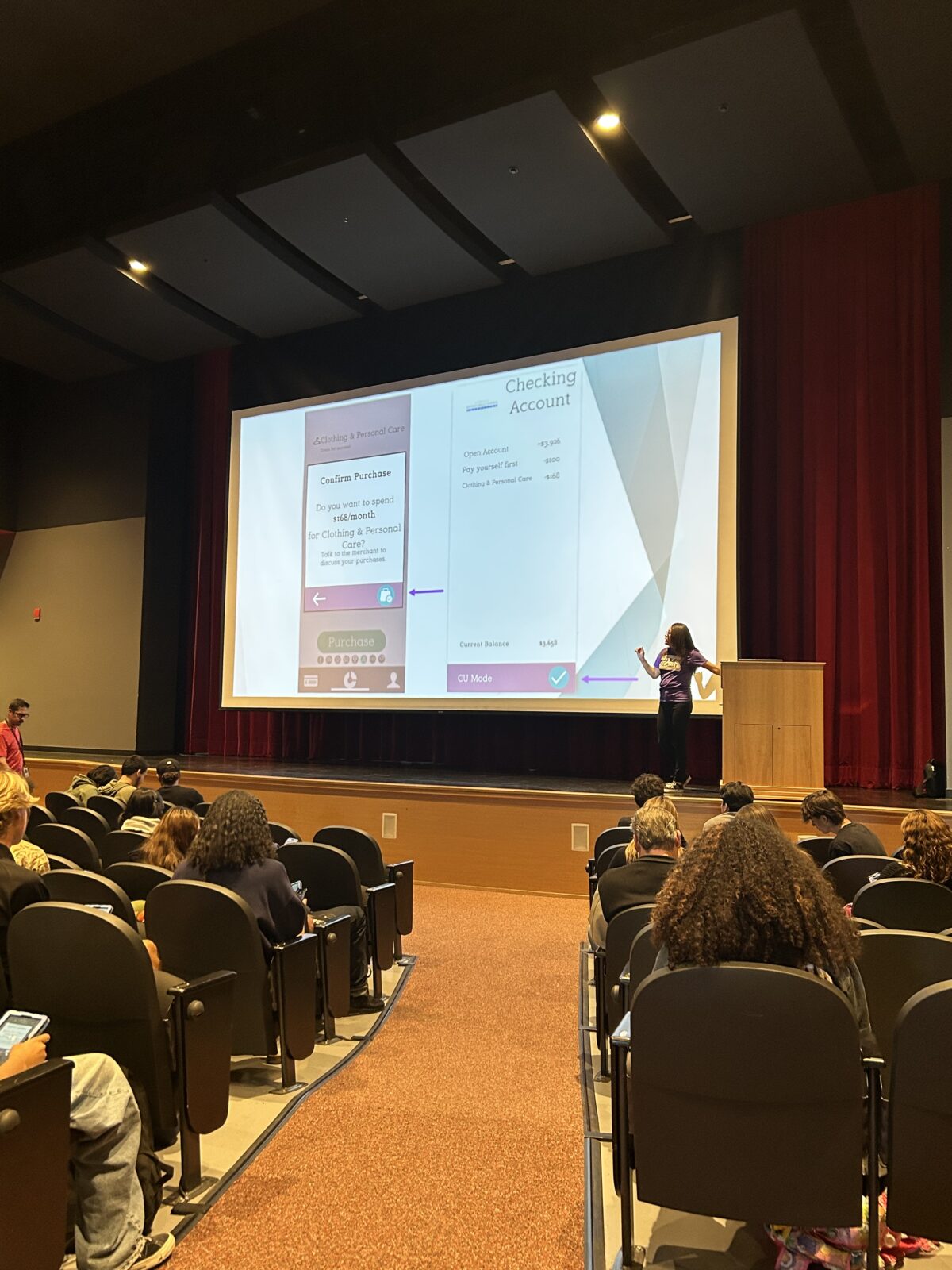

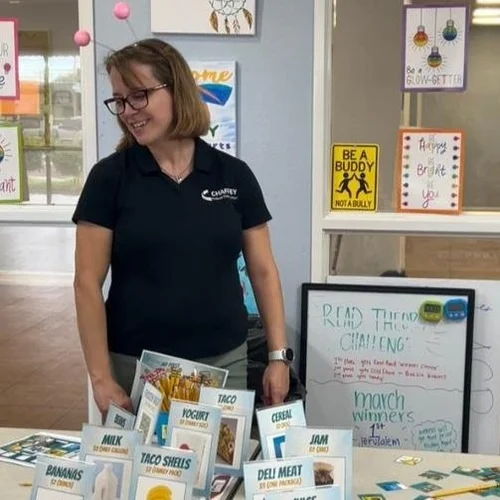

Another difference-maker when it comes to goal setting is to have an accountability partner. If you’re looking for inspiration, this podcast episode shares practical tips for finding an accountability partner and making your goals stick. According to a 2024 Pew Research Study, over 60% of people make a financial-related resolution, yet only 59% of people actually keep all of their resolutions. One way to increase your odds: partner with a coach! Perhaps one way to help you achieve success AND have an accountability partner is to take advantage of Chaffey FCU’s FREE W.I.S.E. financial coaching program. Our program is confidential and 100% tailored to you as an individual and/or with your spouse and other family members. If you have a financial resolution this year, I encourage you to reach out to us for more information!

I am happy to report that while I have not yet harvested any of my lemons, my tree has a lot of budding and developing fruits. I find myself constantly checking the tree and giving a gentle tug on the most mature fruits to see if they are ready to be eaten. Another thing that I constantly check: bread dough. Try out this dinner roll recipe the next time you are hosting dinner, or perhaps just for a Tuesday!

From all of us at Chaffey FCU, we wish you a year filled with growth, success, and financial confidence. As always, thank you for your membership!

PS – I have to admit, my favorite part of that podcast is Memo the Rabbit!

Chaffey’s 2025 Wrapped

A Review of Chaffey’s 2025 Community Impact

For many of us, the New Year is a time for reflection, goal setting, and hopes for the year ahead. At Chaffey FCU, it’s a time to review what we have accomplished in our community in the previous year, so we can set out and create a bigger impact in years to come.

Each year, we strive to educate new students, support a variety of non-profits, and make education more accessible to people in our community. From high school financial education classes to local donations, we hope to illuminate our community in new ways each year. Check out our community impact review for 2025!

Early Direct Deposit? We’ve done that for years!

Early Direct Deposit allows Members like you to receive your paychecks and federal benefits checks as soon as it reaches your account. This means you can cash in on your checks up to 2-days sooner than you could if you had an account without Early Direct Deposit benefits.

While conversations about Early Direct Deposit seem to be growing, Members with a Chaffey FCU Checking Account know that they’ve received this free service for years! If you’re looking for an account that offers free benefits, including the availability to cash in on your check as soon as possible, look no further! Chaffey FCU Checking accounts offer just what you’re looking for.

*Your employer must send payroll data early for Early Direct Deposit to take effect. Contact your employer to confirm availability.

No Tax On Car Loan Interest

New Tax Provisions

DISCLAIMER: The below is general information regarding the “No Tax on Car Loan Interest” available tax deduction as updated in the One, Big, Beautiful Bill that took effect in 2025; it is not tax advice. Chaffey FCU Staff are not tax advisors. Please consult with a tax professional to review your personal tax situation and confirm if you qualify for this new deduction.

Recent changes in tax laws for years 2025-2028 could allow some individuals to deduct up to $10,000 of interest paid on a loan used to purchase a qualified vehicle that meets eligibility criteria. This means if you financed a new, made-in-America vehicle after December 31, 2024, you could qualify for new tax benefits. See below for a general overview of deduction criteria:

Building Wise Financial Resolutions

Insight from our Certified Financial Coaches

The start of the New Year means new goals, changes, and hopes for many of us. While some of us set out to kickstart our fitness journey or begin a personal journal, others choose to take a closer look at our finances. With the help of one of our Certified Financial Coaches, we’ve set out to gather tips to make your Financial New Year Resolutions more attainable.

- Habits to help you reach your New Years savings goals. Learn to understand your relationship with money. Become more aware of certain habits you may not notice. Think about why you’re buying something, before you spend the money on it.

- Tips to help you reach your resolution to pay down debt. Make additional payments on any current debts, before making any new purchases.

- Improve your credit score this year with these best practices. Applying for too much new credit can bring down your score. Only apply for new loans and credit cards when you need to, to avoid opening unnecessary credit lines.

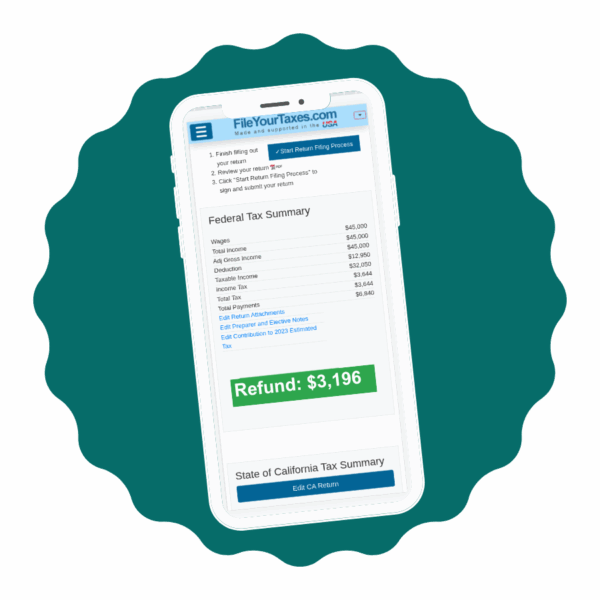

Get a head start on tax season with FileYourTaxes.com

FileYourTaxes.com is an IRS-approved tax software, striving to help you file your taxes quickly, easily, and securely. Filing taxes can be stressful, but with their help, you don’t have to worry! As a nationally recognized leader in tax prep services, FileYourTaxes.com is committed to ensuring your personal information is kept safe and secure.

Get a head start on your taxes with a free tax season checklist!

- View your account and file your return on any device, at any time

- Representatives available to help you navigate the site in English and Spanish

- E-filing is the fastest way to complete your return and receive the money directly into your personal account

- The interview style filing option can make the process easier to understand

- No hidden fees – view FileYourTaxes.com prices on their website

Online Account Opening is Here.

Open new accounts when you want, from where you want.

With Chaffey’s newest online account feature, you now have the freedom to open brand new Chaffey FCU accounts from your computer or mobile smart device. Complete our online application to choose from available products and services online.

Have questions about getting started? Chat with our Virtual Branch team from anywhere by calling or using our online Live Chat in the lower right-hand corner of our website.

Keep Your Credit Cards Happy

Tips for maximizing the benefit of your Chaffey FCU Credit Cards

Credit Cards are a powerful financial tool that, when used correctly, can help you build your financial history, optimize your budget, and earn a variety of rewards – such as Chaffey’s Visa Rewards program. We’ve gathered some tips to help you build your credit card skill set in 2026, while avoiding building debt.

*1 point earned for every $1 spent. Cash advances and balance transfers are not eligible. Must have a Chaffey FCU Visa Credit Card to participate in Visa Rewards. Account must be in good standing to earn Visa Rewards. Business accounts are not eligible. Points are good for 3 years. Speak with a representative or visit chaffey.com/visa-rewards.